vermont state tax department

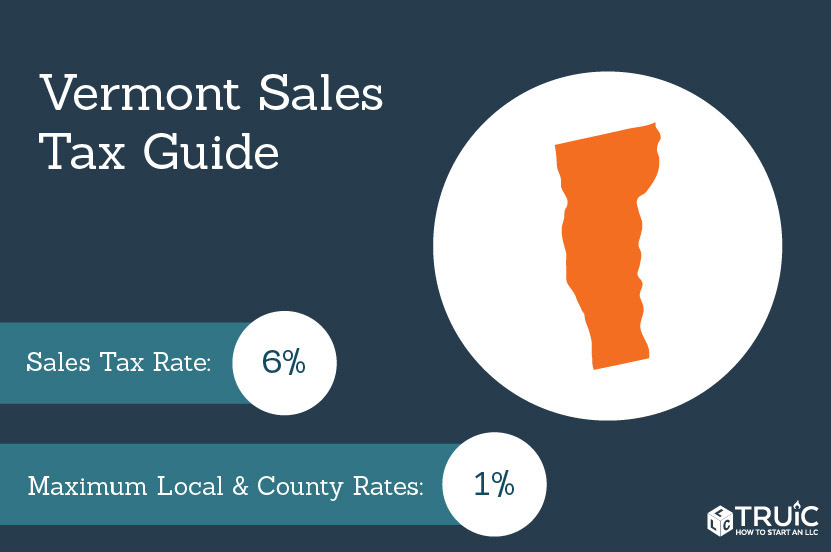

Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. In addition to personal business and corporate income taxes Vermont raises tax revenue through sales and use tax meals and rooms tax property tax and other smaller taxes.

You may now close this window.

. Vermont collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 802 828-2301 Toll Free. Other State Motor Vehicle Department Links.

Like the Federal Income Tax Vermonts income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Secretary of State Secretary of State Jim Condos ServiceNet - Help for Vermonters from the Agency of Human Services. Department of Finance and Management Commissioner Adam Greshin 109 State Street Montpelier VT 05609 Contact Us.

Ready to Relocate to Vermont. Office of the State Treasurer 109 State St Ste 4 Montpelier. Business Start-Up Guide Step-by-step guide and resources for starting a new business in Vermont.

Click here for phone number s Local. Road Conditions Plan ahead and check the conditions before you start your trip. Be the best place to work in Vermont State Government.

The office is open from 745 AM to 430 PM Monday through Friday except State holidays. The documentation fee which represents a charge for the. Ashlynn Doyon at treasurersofficevermontgov.

You have been successfully logged out. The mission of the Vermont Department of Taxes is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers understand and comply with their state tax obligations. Permit Navigator Find out what permits you need using the new.

The Vermont Department of Taxes serves Vermonters by collecting about 30 state tax types to pay for the goods and services people receive from the state. Vermont Fish and Wildlife Find information apply for licenses and permits and learn about conservation. Vermont Department of Taxes.

Events Make plans to participate in events throughout the state all year long. Vermonts maximum marginal income tax rate is the 1st highest in the United States ranking directly. Please address all mail to.

Wheres my Virginia Refund. Click here for Public Records Database. Click Here - For Public Records Database.

Freedom and Unity Live Common Services. No additional registration with the Department is necessary. Although local option tax is levied by the municipality the Department collects and administers the tax.

Retirement System for State Employees VSERS Retirement System for State Teachers VSTRS Risk Management Office of. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont. Reduce the tax gap.

Be a model for service-oriented tax administration. PUBLIC INFORMATION REQUESTS TO. Snowmobile Registration Title Application Instructions.

The Vermont Department of Revenue is responsible for publishing the. The Department will begin processing returns in February. Returns are held until the Department receives W-2 withholding reports from employers which are due on Feb.

Form SUT-451 Sales and Use Tax Return. Check My Refund Status. Business Tax Center Find guidance on paying taxes as a business in Vermont.

Vendors who collect this tax file and remit it to the Department along with their state taxes online or by paper form. Learn about expanding your business or becoming a new resident in the Green Mountain State. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

Generally the Department processes e-filed returns in about 6-8 weeks while paper returns typically take about 8-12 weeks. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. FOR ISSUES WITH THE WEBSITE.

The State Treasurers Office is located on the fourth floor at 109 State Street in beautiful downtown Montpelier Vermont. State Craft Centers and Craft Education Centers. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal.

Vermont also has a 600 percent to 85 percent corporate income tax rate. The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Vermont State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Registration Thu 07012021 - 1200.

Office of the State Treasurer 109 State Street Montpelier Vermont 05609 Main Phone. PUBLIC INFORMATION REQUESTS TO. The Department of Taxes works to help.

Map of 109 State Street. Instructions for completing the Snowmobile Registration Title Application. Are dealer documentation fees taxable.

You can check the status of your Virginia refund 24 hours a day 7 days a week using our Wheres My Refund tool or by calling our automated phone line at 8043672486. Taxes for Individuals File and pay taxes online and find required.

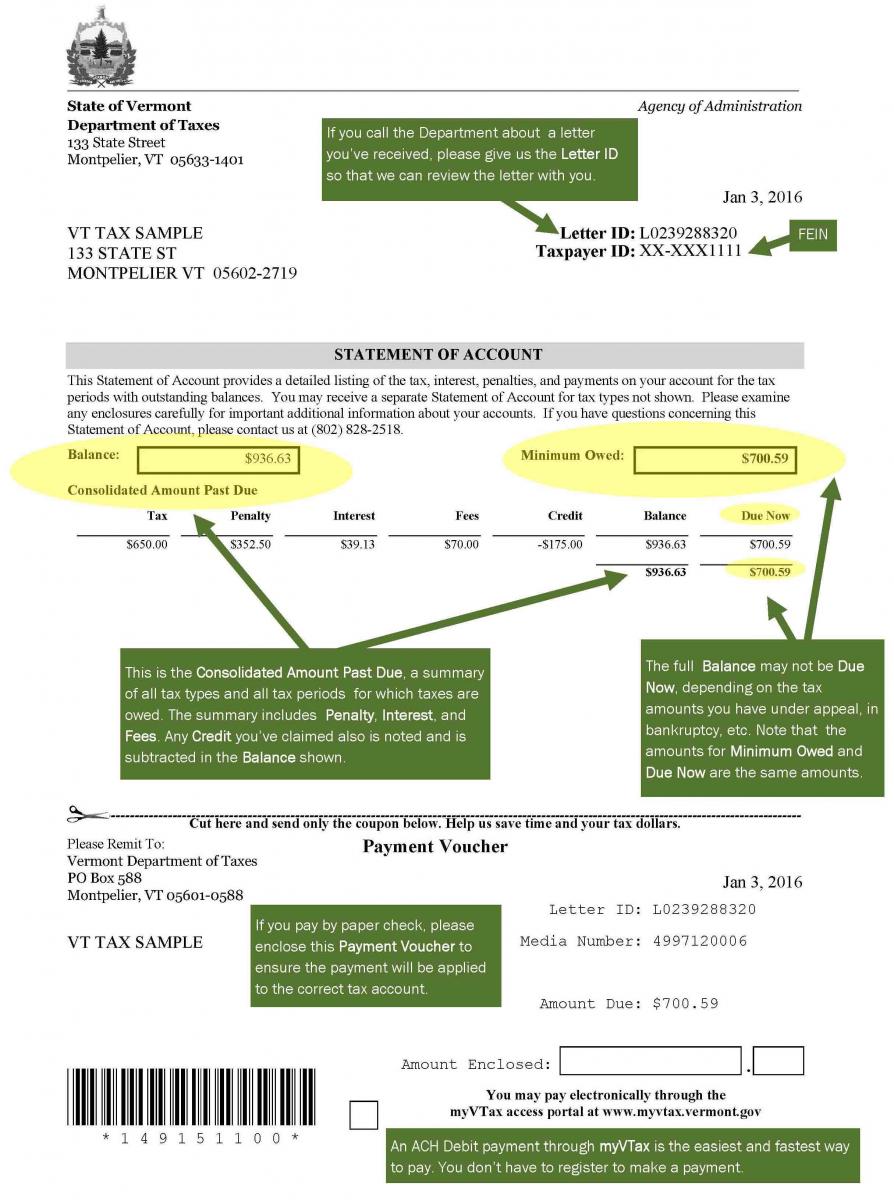

Understanding Your Tax Bill Department Of Taxes

Free Massachusetts Medical Records Release Form Pdf 101kb 2 Page S

Publications Department Of Taxes

Publications Department Of Taxes

Personal Income Tax Department Of Taxes

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Department Of Public Health Mass Gov Public Health Health Department Public

The Most In Demand Jobs Right Now

Vermont Sales Tax Small Business Guide Truic

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

The Most In Demand Jobs Right Now

Follow Vt Dept Of Taxes S Vtdepttaxes Latest Tweets Twitter

Fillable Form Virginia Driving License Renewal 2018 Edit Sign Download In Pdf Pdfrun